IMPORTANT UPDATE: Direct pathway to Australian Citizenship for New Zealanders

The Department of Home Affairs has just announced a new instrument to introduce concession for the subclass 189 visa – New Zealand Stream. Previously, we have wrote about the changes that the New Zealanders only have to prove taxable income for at least 3 years of the last 5 years prior to lodging an application. This proposal will come into effect from 1 July 2021, as well as concessions for those whose income are affected by Covid-19 circumstances.

Related:

As per the changes, to apply for this visa, the applicants must meet the following requirements (from 1 July 2021):

- Must be a holder of Special Category Visa (subclass 444).

- Applicants must have been usually resident in Australia for a continuous period of five years immediately prior to application, and have commenced that period of usual residence on or before 19 February 2016.

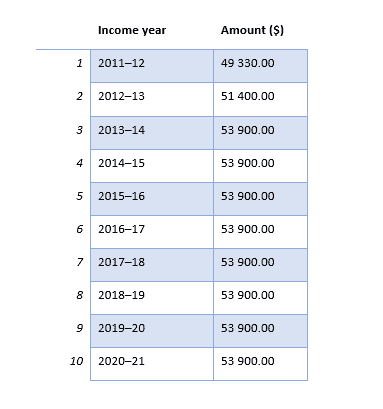

- Have the taxable income (table below) at or above the income threshold for at least 3 of the last 5 income years prior to lodging an application (unless claiming an exemption)

Many New Zealanders in Australia have been affected by Covid-19 situation and therefore could not meet the income threshold, especially for the year 2019 – 2020. Therefore, the Department of Home Affairs has added a new class of applicants who are eligible for exemption if they can prove their income has been reduced due to the pandemic.

According to the new instrument, the following classes of applicants are eligible for income requirement exemption:

| Item | Classes of exempt applicants | Evidence |

1 – Primary carer of a child |

The applicants who have primary care of a child, and that child cannot be removed from Australia or the child needs to be in Australia to access to all parents’ care. | Any of the following documents

(a) a parenting order. (b) a registered parenting plan. (c) a written parenting plan. (d) a consent order. |

2 – Injury |

The applicants who were receiving compensation for an injury that prevented the applicant to reach the threshold, and that injury needed ongoing rehabilitation or compensation would discontinue if the applicants left Australia. | Any of the following documents:

(a) a statutory declaration by the applicant setting out the applicant’s personal circumstances. (b) a statutory declaration by the applicant’s employer stating a return to work date and the applicant’s income amount. (c) a medical certificate for the applicant. (d) official compensation documentation relating to the applicant. (e) official rehabilitation documentation relating to the applicant. |

3 – On parental or carer leave |

The applicants who were on an approved parental or carer’s leave and:

· Before the period of leave, their income met the income threshold; and · Has resumed or will resume work with the income that meets the threshold. |

Any of the following documents:

(a) a statutory declaration by the applicant setting out the applicant’s personal circumstances. (b) a statutory declaration by the applicant’s employer stating a return to work date and the applicant’s income amount. (c) a birth certificate for the applicant’s child. (d) a medical certificate for carer responsibilities. (e) notice of approved parental leave. |

4(Recently Added – Covid19 concession) |

The applicant:

(a) would have likely met the minimum amount of the income requirement for the 2019–20 income year if not for the effect of the COVID‑19 pandemic; and (b) could not meet the minimum amount of the income requirement for the 2019–20 income year because of the effect of the COVID‑19 pandemic on the Australian economy. Based on this new instrument, the concession on income only applied to financial year 2019 – 2020. |

(a) either:

(i) a signed letter written on a company letterhead by the applicant’s current or former employer stating the applicant’s salary before 1 February 2020; or (ii) the applicant’s pay slips, salary advices or employment contracts (stating the applicant’s salary) for a period in the 2019–20 income year to demonstrate that the applicant was likely to meet the income threshold in the 2019–20 income year; and (b) any of the following documents: If currently employed

(i) a statutory declaration by the applicant’s employer acknowledging the applicant’s 2019–20 taxable income has reduced, due to: (A) reduced availability of shifts/hours resulting in a drop in income; or (B) the applicant contracting COVID-19 or having caring responsibilities for a person who contracted COVID-19, preventing the applicant from working and resulted in a drop in income; or (C) medically directed orders to self-isolate, preventing the applicant from working and resulting in a drop in income; or (D) caring responsibilities as a result of COVID-19 pandemic shutdowns (e.g., schools, childcare centres) that prevented the applicant from working and resulted in a drop in income; If the employment has terminated (ii) a statutory declaration by the applicant’s former employer stating that the circumstances of the applicant’s dismissal were related to the COVID-19 pandemic effects on the business; (iii) documentation proving that the applicant had access to the JobKeeper Wage Subsidy for a period in 2019–20 income year including either: (A) employee nomination form; other statements or documents provided by the ATO demonstrating that the applicant had access to the JobKeeper Wage Subsidy; or (B) alternative statements provided by the ATO at the applicant’s request; (iv) Services Australia-Centrelink letters showing the applicant claimed and received the JobSeeker payments for a period in 2019–20 income year. |

Related:

- COVID-19 concessions for Employer-Sponsored visas (SC457-482 and 186-187)

- COVID-19 Concessions for Business visas

- COVID-19 Concessions for Subclass 485 (Temporary Graduate) visas

- COVID-19 Concessions for Skilled Regional 887 visa

- COVID-19 waiver for offshore Partner visa grant requirement

- COVID-19 Concessions for 189 New Zealand Stream visa

- Skilled Independent (Subclass 189) (New Zealand) Stream

National Innovation Visa – South Australia Criteria

Iran Visa Support – Australia

Immigration updates (Skilled, Employer and family visas) June 2025

National Innovation Visa – NSW Criteria

Registering as a Midwife in New Zealand (Non-AU/NZ Trained Applicants)